Success Tax Professionals Chermside

Specialising in business and individual tax returns, financial statements, business activity statements, bookkeeping and other accounting services, Success Tax Professionals in Chermside are able to provide effective and efficient taxation services and advice for all individuals and businesses.

Eva Chan is the accounting principal of Success Tax Professionals Chermside located at Shop 1/19 Thomas Street. Eva is CPA Australia accredited and holds a Master of Business (Professional Accounting) from the Queensland University of Technology.

Eva’s tax and accounting practice provides services in English, Cantonese and Mandarin. Customers can choose from a wide array of professional tax and accounting services including:

- Asset protection, budgeting, business strategy and planning,

- Bookkeeping and payroll,

- Business activity statements

- Business structure set-up and review,

- Instalment activity statements

- Rental properties,

- Salary and wage tax return preparation,

- Review of tax refunds,

- Amendments,

- SMSF (self managed super funds) – set-up, accounts, tax and audit,

- Tax return preparation and compliance for businesses – partnerships, companies and trusts, and

- Tax planning.

Eva says, ‘At the Chermside practice we regularly review all our clients’ circumstances and business structures. We identify the risks and opportunities and we help business owners make informed decisions to maximise profits, cash flow and tax savings.’

Eva and her team welcome new customers to join their client base of highly satisfied repeat and referred clientele.

Slideshow gallery

(Mouse over image to pause)

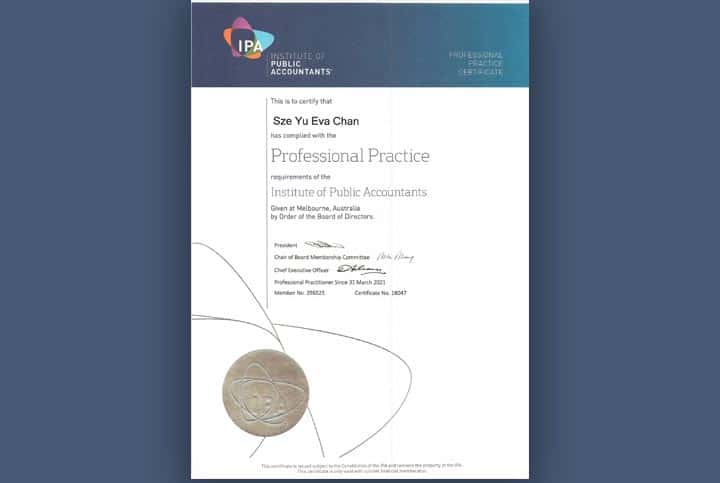

Institute of public accountants certificate

Front entrance to Success Tax Professionals practice in Chermside

Legally reduce your tax liability and make savings.

Details

Chermside QLD 4032

Australia

Mobile: 0433 881 443

Email: [email protected]

Info: Tax Agent No. 26090279.

Servicing Options

- In person at our office

- We can visit you

- Phone

- Online video

- Messenger apps/programmes

- We use Zoom, WhatsApp, WeChat and Line

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.