Donations

Taxpayers are generally entitled to claim donations and gifts made to Deductible Gift Recipients (‘DGR’), including various funds, authorities and institutions listed or described in Division 30.

Donations may be deductible to the following:

- Public or non-profit hospitals.

- Public benevolent institutions.

- Approved scientific research institutes.

- Certain famine and natural disaster appeals.

- Public funds providing money for buildings used as semi-government or private non-profit schools or colleges.

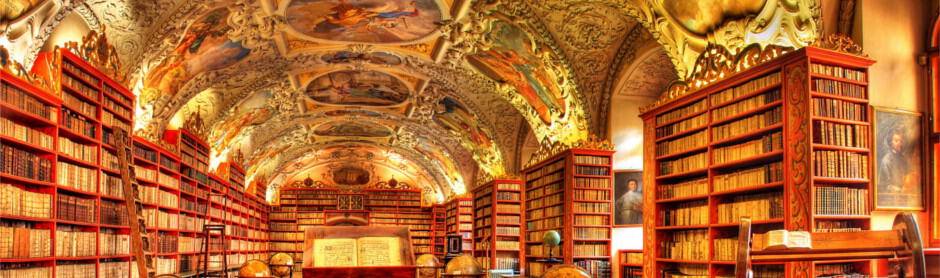

- Public libraries, museums and art galleries.

- Public authorities or institutions engaged in research of the causes, prevention or cure of disease in human beings, animals or plants.

If a particular recipient is not a DGR then a deduction cannot be claimed. An entity’s gift-deductible status can be found on the Australian Business Register at www.abr.business.gov.au

The gifts must be in money or property and be for $2 or more. Donations cannot give rise to a tax loss or increase a tax loss. In addition, the taxpayer giving the donation cannot get a benefit in return for the donation. So for example, donating $20 to a DGR, and receiving pens or a raffle ticket in return, will make the donation non-deductible.