Success Tax Professionals Burswood

James Jin and Stone He are the accounting principals of Success Tax Professionals at the centrally located office in Burswood, WA.

The practice has special interests in the following areas:

- New business start-up services and advice. This includes due diligence, business projections, business tax administration (ACN, ABN, TFN and PAYG), compliance (e.g. IAS and BAS), smoothing transition, budgets and cash flow, financial reporting, and tax review.

- ‘Already in business’ services include advice on business expansion and growth, CFO – real-time analysis, KPI analysis, financial reporting, tax planning, private rulings, management reporting and investment properties.

- Professional development for undergraduates, postgraduates, bookkeepers and accounting professionals via a student membership programme and internship programme.

The practice was previously located on Aberdeen Street in Perth but moved in 2019 to Stiles Avenue in Burswood due to expansion and diversification, which currently includes the on-going development and delivery of a training division and internship programme.

James says, ‘Our practice team are fluent in English, Mandarin, Cantonese, Teochew and Hokkien, and we welcome all clients. There is no doubt that many Chinese clients feel comfortable working with us due to language and culture, but our practice is a modern Australian practice catering to everyone.’

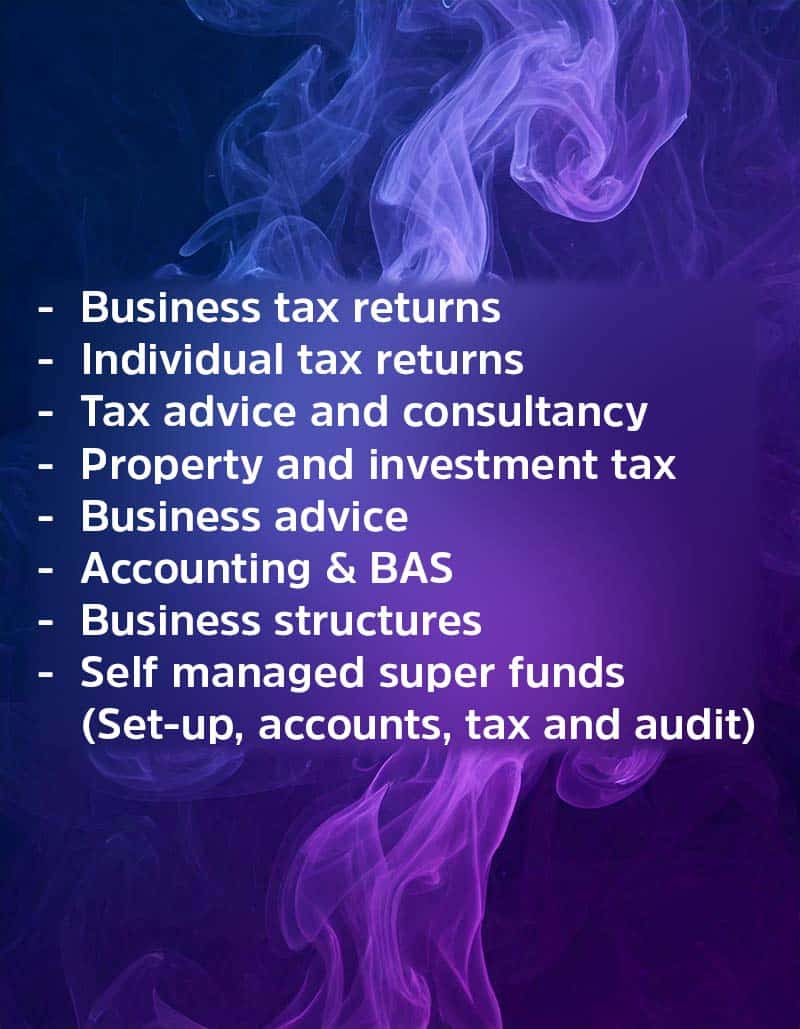

The practice also delivers general services in accounting and taxation including:

- Business activity statements,

- Business advice,

- Cash flow improvement for business,

- Instalment activity statements,

- Review of tax refunds,

- Salary and wage tax return preparation,

- Self managed superannuation funds

- Tax return preparation and compliance for partnerships, companies and trusts,

- Business structure set-up and review, and

- Asset protection

Slideshow gallery

(Mouse over image to pause)

The Burswood team outside their office at 25A Stiles Avenue.

Trouble finding a job? Or perhaps you want to change from private to public sector accounting and tax? Make the call today to talk about how your skills can be upgraded.

Stella Leong, one of the principals of Success Tax Professionals Burswood, provides a presentation at a recent intern briefing.

Intern selection briefing. The Burswood office provides a public practice training programme to industry accountants.

Intern assessment session 5 August 2019 - staff and interns.

Legally reduce your tax liability and make savings.

The Burswood office provide training and a structured intern programme.

Intern presentation, for skill improvement and enhanced employability.

Intern programme briefing.

Details

Burswood WA 6100

Australia

Phone: 08 9467 3652

Mobile: 0430 886 866 or 0433 192 468

Email: [email protected]

Info: Tax Agent No. 26075124. Languages - English, Mandarin, Cantonese, Teochew and Hokkien.

Servicing Options

- In person at our office

- We can visit you

- Phone

- Online video

- Messenger apps/programmes

- We use Zoom, Google Hangouts, WeChat and WhatsApp

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.