Success Tax Professionals Ashfield

Contact the accounting principal, Leo Wang, of Success Tax Professionals in Ashfield for accounting and taxation services.

The Ashfield practice provides tax return preparation for individuals and businesses, BAS services, instalment activity statement compliance, end of year financials, general accounting, and a range of services for partnerships/companies/trusts/self managed super funds and sole traders.

Leo says, ‘I really believe all businesses should be in touch with their accountant for at least an annual review and often much earlier if circumstances change. It can mean the difference between achieving tax savings or completely missing out.

‘A consultation can result in the application of beneficial or even newly introduced tax incentives to a business owner’s circumstances. Sometimes it involves registration, validation or other changes to be implemented well before a benefit can be accessed or realised by the owner. That’s why it is best to get on to these things quickly. Many things cannot be backdated, so business owners should seek advice quickly to get the best outcome.’

Services:

- Tax return preparation and lodgement,

- Business activity statements

- Accounting and financials for business,

- Instalment activity statements,

- Cash flow analysis and improvement,

- Payroll services,

- Change of business structure,

- Private rulings, and

- SMSFs (set-up, accounts, tax and audit).

The Ashfield practice offers appointments outside of standard business hours for clients who find it difficult due to work, childcare arrangements or family circumstances to book within normal business hours. Simply contact Leo and discuss an alternative time.

Slideshow gallery

(Mouse over image to pause)

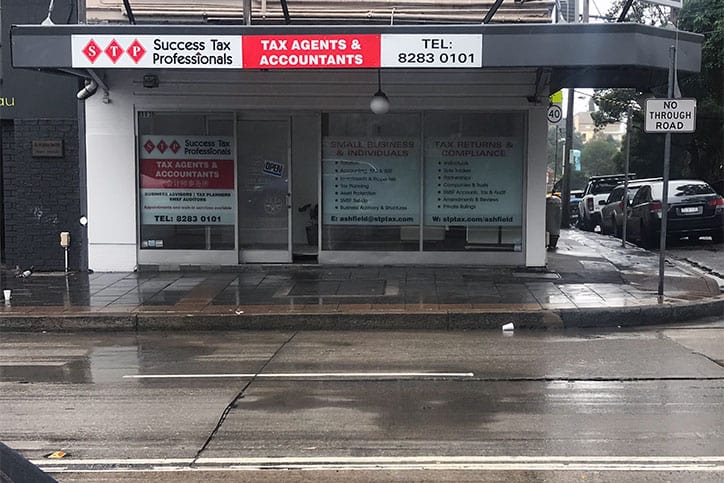

Success Tax Professionals in Ashfield NSW.

Principal accountant and owner - Leo Wang.

Success Tax Professionals Ashfield provides services to businesses, individuals and SMSFs.

Flexible appointments are available at the Ashfield office during business hours and also after hours. Just ask.

Legally reduce your tax liability and make savings.

Ashfield tax accounting office.

Ashfield office interior.

Ashfield office interior.

Details

Ashfield NSW 2131

Australia

Phone: (02) 8283 0101

Mobile: 0406 807 648

Email: [email protected]

Servicing Options

- In person at our office

- Phone

- Online video

- Messenger apps/programmes

- We use Zoom, FaceTime, WhatsApp, WeChat and Skype

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.