Success Tax Professionals Kalamunda

The accounting principals of Success Tax Professionals in Kalamunda, Trevor and Carole van Luinen are well known in the local area. The town, on the eastern limits of the Perth metro area with its country feel has an active central hub with restaurants, local businesses and shopping.

‘We have a lot of local clients from areas like Pickering Brook, Helena Valley, Carmel, Mundaring and Gooseberry Hill. We’ve built a very sound reputation and profile in the area. Even people further afield travel to us for tax compliance, accounting and consultative services,’ says Carole van Luinen.

‘We’re on the urban fringe so we understand business that is not only city-based but rural as well. Individual taxation return clients with rental properties and retirees with investments also feature highly in our client base.

‘Our practice team are community focussed. We genuinely take time to work with our clients and get to know them,’ adds Trevor van Luinen.

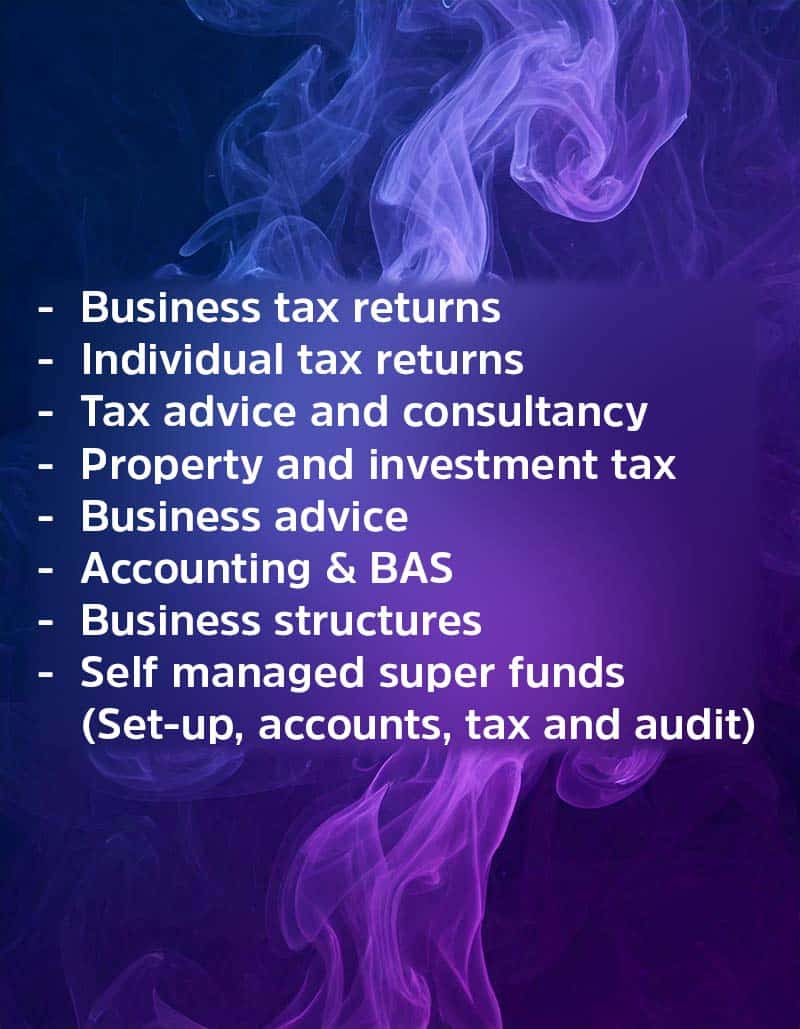

The Kalamunda practice provides taxation and accounting services to individuals and businesses, including self managed super funds. They also investigate ATO private rulings and complex tax matters where clients have grounds for review or special circumstances.

Slideshow gallery

(Mouse over image to pause)

Details

Kalamunda WA 6076

Australia

Phone: 08 9257 1500

Mobile: 0407 700 051

Email: [email protected]

Info: Tax Agent No. 76680004.

Servicing Options

- In person at our office

- Phone

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.