Success Tax Professionals Kewdale

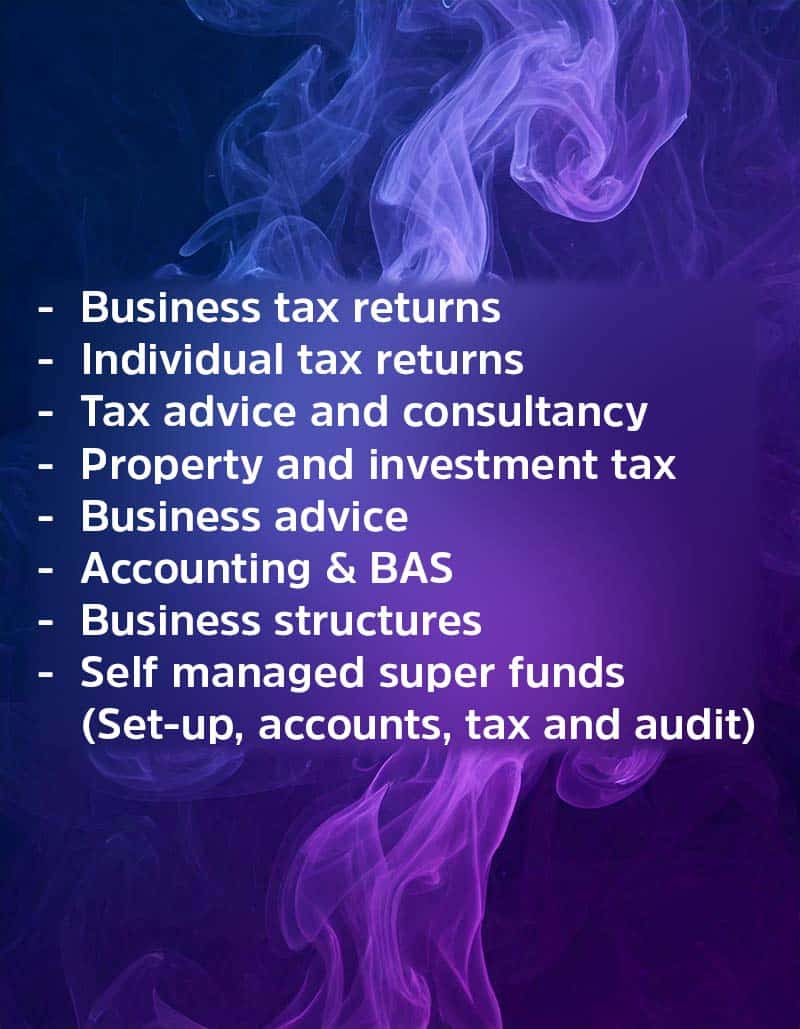

Success Tax Professionals in Kewdale provides services to businesses, individuals and also to clients with self managed super funds. The practice team have a special interest in business structures – including partnerships, companies, trusts and sole traders. They also provide tax return preparation, lodgement and review services.

The practice achieved placement in the Top 10 practices for 2020 within the Success Tax Professionals network, based on performance results in the 2018/19 financial year, validating the practice’s focus on results and overall customer servicing.

The principal, Nishan Senaratne is a public accountant and a registered tax agent. Nishan holds a certificate in public practice from the Institute of Public Accountants, an accounting degree from Edith Cowan University and a post graduate degree in tax from Curtin University. Nishan has been in public practice for well over 10 years and prior to practice was in the corporate sector where he was the accountant at the Australian Medical Publishing Company in Sydney.

Nishan made the transition into public practice because he wanted to have contact with the public and take on more challenging and rewarding work.

‘In my accounting and taxation practice I have the opportunity to meet people from all sorts of occupations, industries and businesses. Unlike private sector work which can be isolated and quite singular in focus, public practice provides such an interesting work environment,’ says Nishan.

‘At the Kewdale practice we get background information about our clients at the interview stage so that we can research effective options that match their circumstances. Too many industry accountants rely on tax basics that they knew five, ten or even more years ago. In our practice we are constantly looking at new material and changes. There is a lot of advanced information out there.

‘We also like to look at interesting areas in the field of business. Tax legislation for ‘art’ in the workplace is a good example. Art creates great ambience and positive feelings in the office, workshop or factory. There are tax-deductible benefits here for business owners, plus art can be an investment and provide capital gains over time,’ adds Nishan.

Slideshow gallery

(Mouse over image to pause)

Legally reduce your tax liability and make savings.

Details

Kewdale WA 6105

Australia

Phone: 08 9353 2822

Mobile: 0455 716 106

Fax: 08 9353 2933

Email: [email protected]

Info: Tax Agent No. 25496330.

Servicing Options

- In person at our office

- We can visit you

- Phone

- Online video

- Messenger apps/programmes

- We use Zoom and Viber

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.