Success Tax Professionals Alkimos

Success Tax Professionals Alkimos provides an extensive range of accounting and taxation services for businesses and individuals. The practice conveniently offers services at their modern and stylish office premises.

The principal, Kristina Kritskikh says, ‘The Alkimos practice offers services with quite flexible hours. If the standard hours do not suit someone’s circumstances, they are most welcome to ask if we can accommodate an alternative time. Different types of work can also be managed electronically which can remove the need for multiple in-person meetings. I aim to keep workflows simple and efficient.’

The practice provides services in English, Russian and Polish, with multilingual Kristina also having comprehension of most Slavic languages and some Kazak.

Services include:

- Tax returns for individuals and businesses,

- Business activity statements,

- Instalment activity statements,

- Accounting and bookkeeping,

- Payroll services,

- Business advice, review and restructuring,

- Tax advice and planning,

- Business analysis and budgeting,

- Tax for properties and investments, and

- Self managed super funds.

Success Tax Professionals Alkimos are also able to provide business owners with services related to Xero and MYOB – including set-up and familiarisation training. Payroll services are also available. The practice participates in training to stay across enhancements and software changes.

Slideshow gallery

(Mouse over image to pause)

Legally reduce your tax liability and make savings.

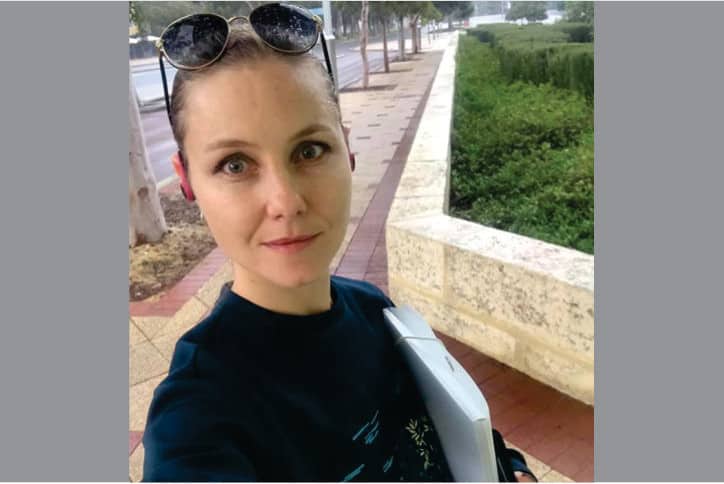

Kristina Kritskikh - tax accountant.

Outside of work, family time is important and that means quality time with daughters Yana and Isabella.

Come and meet Smurth the beagle - family pet and personal assistant at the Heathridge office.

Mobile services - a convenient and easy option for at home or on-site tax services.

Kristina loves to travel even if it is minus 20 degrees. Here she is in Kazakhstan.

Mobile services - no problem! Kristina visits homes and businessess as well as offering tax or accounting services at her Heathridge office.

Going on-site to visit businesses - even if it is a hard hat area, Kristina is available to meet with business owners to deliver tax saving services.

Kristina at the Edith Cowan University Open Day. Good accountants continue to further their education and learning.

Details

Alkimos WA 6038

Australia

Mobile: 0438 731 982

Email: [email protected]

Info: Languages - English, Russian, Polish, most Slavic languages and some Kazak.

Servicing Options

- In person at our office

- Phone

- Online video

- Messenger apps/programmes

- We use Zoom, Skype, WhatsApp, FaceTime and Facebook Messenger

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.