Success Tax Professionals Ballajura

Ben (Amir) Banai is the accounting principal of the Success Tax Professionals Ballajura office. The office is located inside the shopping complex at the Ballajura City Shopping Centre and is surrounded by plenty of parking. Ben has operated his tax practice from this location since 2010.

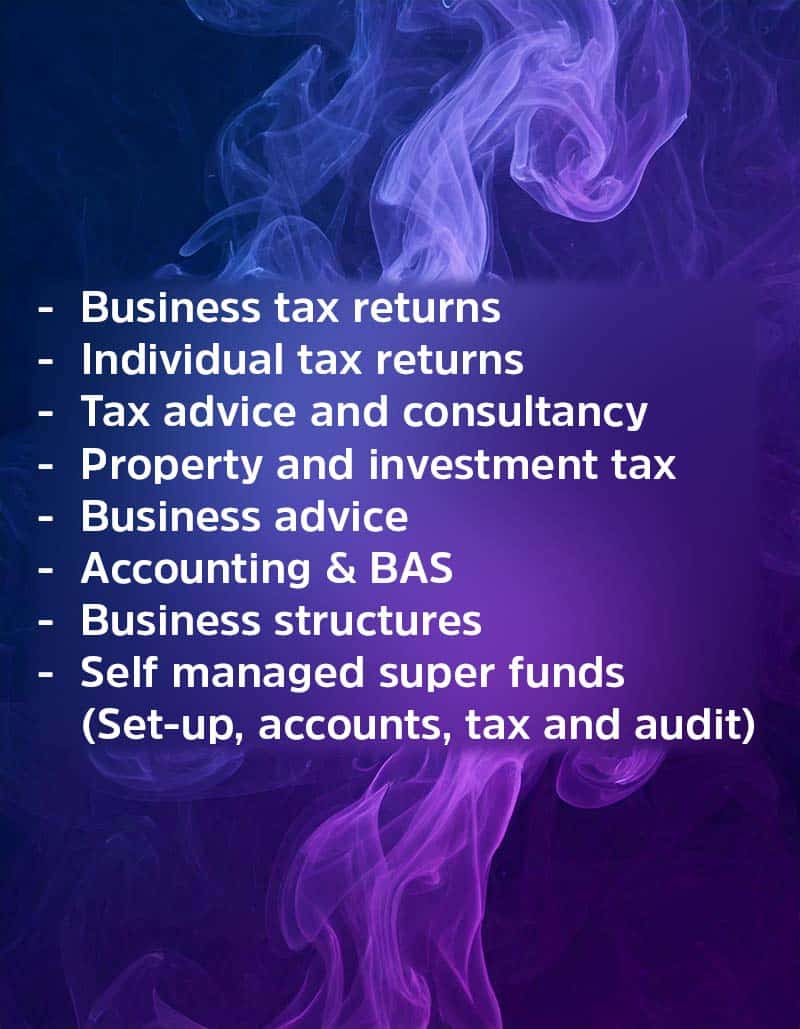

New and existing clients are welcome to contact Ben to discuss their taxation or accounting requirements. Services include:

- Taxation returns,

- BAS and GST,

- Instalment activity statements

- Business advice,

- Business restructuring – including change of structure,

- Cash flow analysis and improvement,

- Asset protection,

- General accounting and end of year financial statements,

- Tax planning, and

- Self managed super funds (set-up, accounts, tax and audit).

To make a time to see Ben, please call him on 08 9249 4420, or if you happen to be at the centre drop in to either make a time or see if you can be seen at short notice. Sometimes walk-in services are possible.

Slideshow gallery

(Mouse over image to pause)

Details

225 Illawarra Cres South

Ballajura WA 6066

Australia

Phone: 08 9249 4420

Mobile: 0424 260 696

Fax: 08 9249 4420

Email: [email protected]

Info: Tax Agent No. 25787589. Languages - English and Persian.

Servicing Options

- In person at our office

- Phone

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.