Success Tax Professionals Cockburn Central

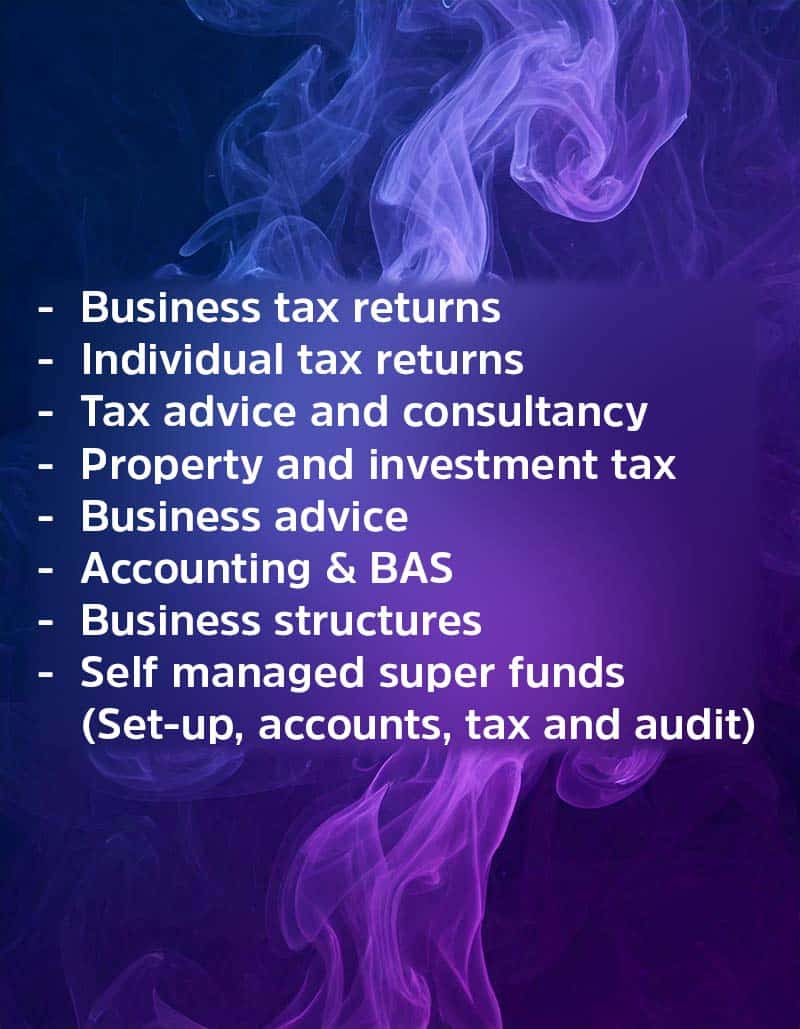

The Cockburn Central practice provides a comprehensive suite of services including general taxation, BAS, SMSF, taxation advice, business structure set-up, accounting and business restructuring.

The practice prides itself on fast turnaround timeframes for responding to emails and phone calls. Their in-house policy and systems for customer service delivery ensures that client emails and phone calls are all addressed within one hour, with 99% of all incoming calls actually being addressed immediately.

The accounting principal of the Cockburn Central practice, Munit Goyal says, ‘Our practice has a very strong focus on timeliness and communication. Good communication with our clients forms the basis for obtaining factual data and really getting to the core of applying a wide range of tax saving measures. Why only apply two measures if there are four or five, for example, that really fit a client’s circumstances. At our practice we want to genuinely optimise results and target everything.’

The Cockburn Central practice reviews each business client’s goals and objectives on an annual basis to factor in new developments, and to also work ahead of proposed changes in tax law and policy.

Cockburn Central provides a very intensive service to businesses for:

- Timeliness of work,

- Tax minimisation,

- Organisation of their data,

- Reporting and analysis to understand results and to target improvement, and

- Provision of software to allow self-monitoring and performance tracking.

‘A dedicated member of our accounting practice team is always just a phone call or email away if there are any problems that a client may have with accounting software’, says Munit.

Slideshow gallery

(Mouse over image to pause)

Details

817 Beeliar Drive

Cockburn Central WA 6164

Australia

Phone: 08 9417 1880

Mobile: 0432 100 193

Email: [email protected]

Info: Tax Agent No. 24781225.

Servicing Options

- In person at our office

- Phone

- Online video

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.