Success Tax Professionals Ellenbrook

Success Tax Professionals in Ellenbrook cater for tax and accounting services by appointment and also on a walk-in basis.

‘Our tax accounting practice will definitely see clients if we have capacity and they just happen to walk in, otherwise we will provide the option to wait or to make an appointment for a time that suits them. We do however ask clients requiring business consultations to make an appointment so that we can ensure we dedicate the required time to thoroughly discuss their circumstances, Business is a very diverse area,’ says Daleen Jansen Van Rensburg, the principal of the Ellenbrook practice.

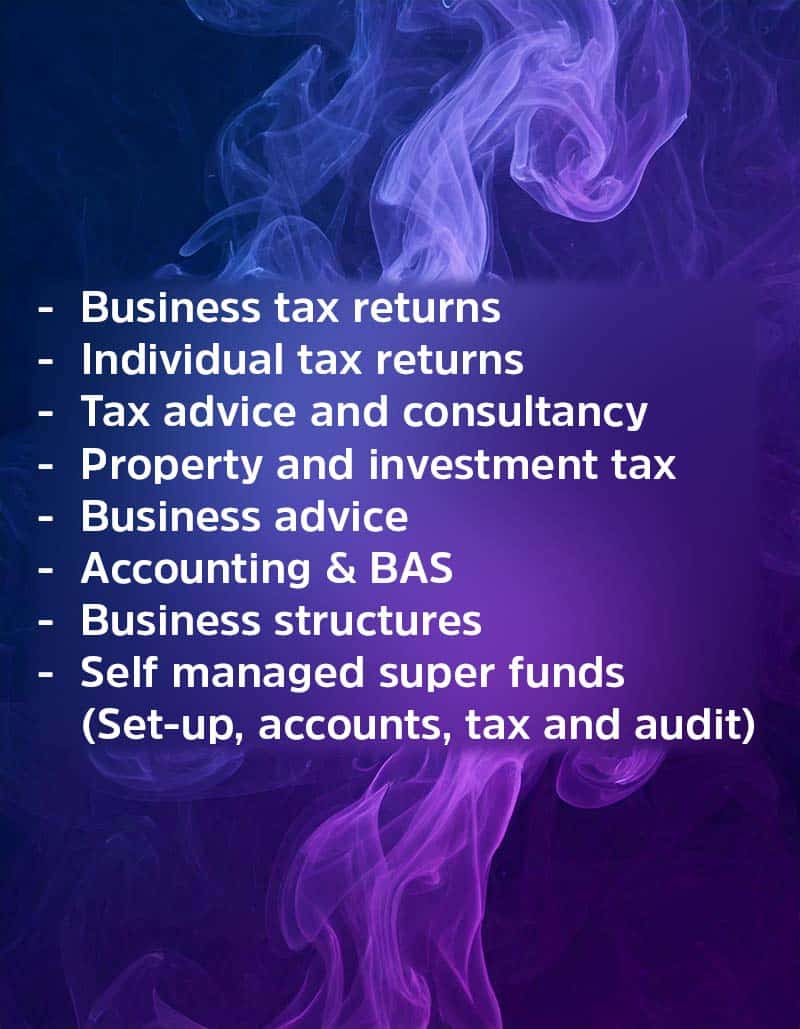

The practice delivers services for a wide range of accounting and taxation including:

- Business activity statements,

- Business advisory,

- Cash flow improvement for business,

- Instalment activity statements,

- Review of tax refunds,

- Salary and wage tax return preparation,

- Self managed superannuation funds

- Tax return preparation and compliance for partnerships, companies and trusts, and

- Taxation planning.

‘We provide a very comprehensive suite of products specifically focussed on business restructuring, taxation planning and profitability.

‘Whether a client is a business owner or an employee working on wages there are so many tax planning options available. In fact we use over 250 of them on a regular basis for clients seeking this level of service, ’ says Daleen.

‘For example, for rental property owners we can look at salary packaging rental property expenses to double-dip and save GST. Salary packaging of private motor vehicles is also a very effective strategy for both business owners and individuals. Tax Planning is a very specialised area that identifies structural change so that deductions and savings can be applied and it is best to seek a full assessment,’ adds Daleen.

Slideshow gallery

(Mouse over image to pause)

Daleen Jansen Van Rensburg with STP CEO, Darren Gleeson, implementing tax planning as a practice service.

Australian Accounting Awards Finalist 2020

Office front

Reception

Australian Accounting Awards Finalist 2019

Waiting area

Legally reduce your tax liability and make savings.

2018 award achiever in the STP Top 10 Practices. Great news, Ellenbrook also qualified in the Top 10 practices for 2019.

Nominated for the Australian Accounting Awards 2019.

Daleen at the 2019 Australian Accounting Awards night.

Daleen is a Justice of the Peace. Pictured here taking the Oath for JP services.

Daleen participating in the bikers annual toy run for children (charity event).

Daleen's youngest son is an avid basketball player. Success Tax Professionals Ellenbrook are proud to sponsor the team.

Details

Ellenbrook WA 6069

Australia

Mobile: 08 9296 8327

Email: [email protected]

Info: Tax Agent No. 25542698.

Servicing Options

- In person at our office

- Phone

- Online video

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.