Success Tax Professionals Southport

Accountant and business advisor, Chris Black, is the accounting principal and owner of Success Tax Professionals Southport in Queensland.

Chris has a strong focus on business improvement advice and strategies.

Chris says, ‘Paying tax is a consequence of making a profit – so maximising profit and minimising tax payable is a combined goal. Reviewing a business using the concepts of risk management can open up new opportunities and niches where margins and subsequently profit can be improved.’

Prior to public practice Chris also had extensive private sector experience maximising production margins while minimising risk in $800 million-plus entities. He has also worked in the accounting field throughout the Asia Pacific region – including Laos, Papua New Guinea, South Korea, China, Thailand and Indonesia.

Chris holds a Bachelor of Business and Master of Accounting and is a member of the Institute of Public Accountants.

Chris adds, ‘Many accountants only provide straight tax services rather than value-added services that emerge through business development opportunities. At the Southport practice we aim to add value through business support and early identification of options. Tax planning, for example, provides excellent opportunities in so many areas. We can also look at cash compared to accrual accounting methods, concessions for primary producers, salary packaging of private motor vehicles, the small business income tax offset, SMSFs – which can result in a 0% tax rate when in 100% pension phase, and so many other areas.

‘With business we can look at increasing margins and profitability. Factors can include helping a client understand the market in which their business operates in, identifying the high margin products and maximising sale of these products. We can also look at price sensitive markets and whether a client should transition out of their business or implement changes.’

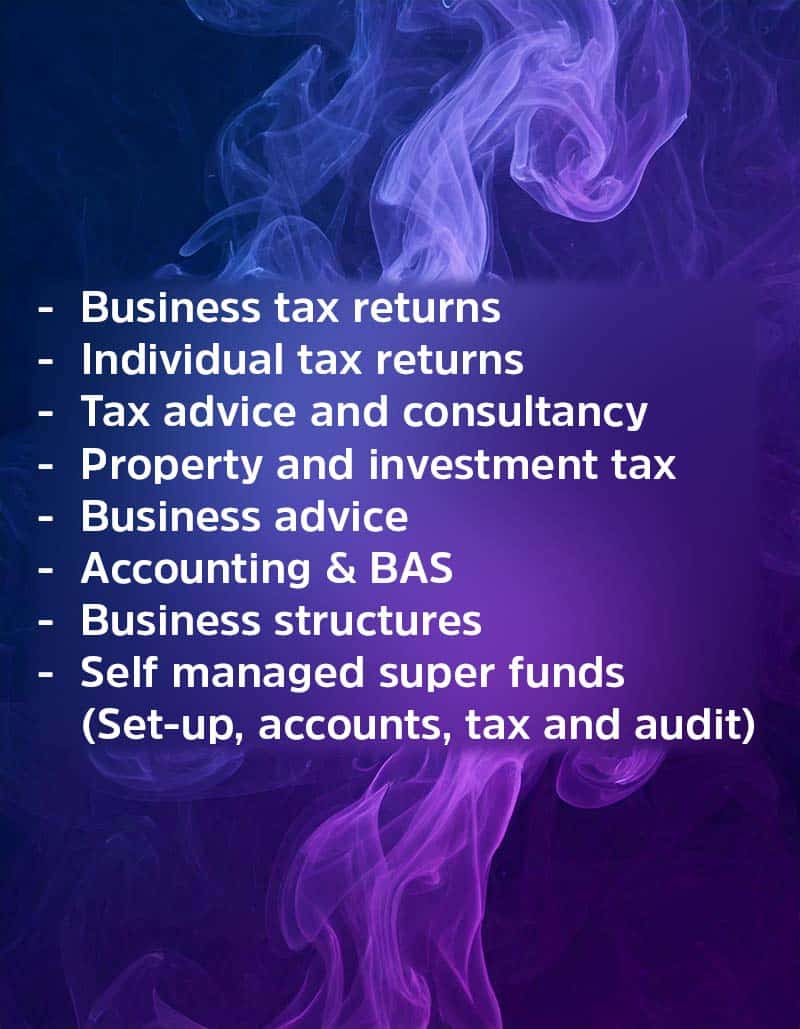

The practice provides the full range of accounting and taxation services to individuals and businesses including sole traders, partnerships, companies, trusts and SMSFs.

Specialist areas include business structure set-up and review, self managed super funds and tax planning opportunities. Review of business structures produce many flow on benefits and might include moving a sole trader to a Pty Ltd structure with correct measures for tax and financial management, chart of accounts, asset protection and risk management identification.

The practice responds to most inquiries immediately or within two hours.

Slideshow gallery

(Mouse over image to pause)

Details

Southport QLD 4215

Australia

Mobile: 0404 621 903

Email: [email protected]

Info: Tax Agent No. 25588286.

Servicing Options

- In person at our office

- Phone

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.