Success Tax Professionals Travancore

Success Tax Professionals in Travancore Victoria is the boutique practice of accounting principal Nikesh Pokhrel.

Nikesh works on a one-to-one basis with his clients. Clients know exactly who they will see and can form a strong working relationship to achieve their goals and to also receive benefits and information that is helpful, meaningful and constructive.

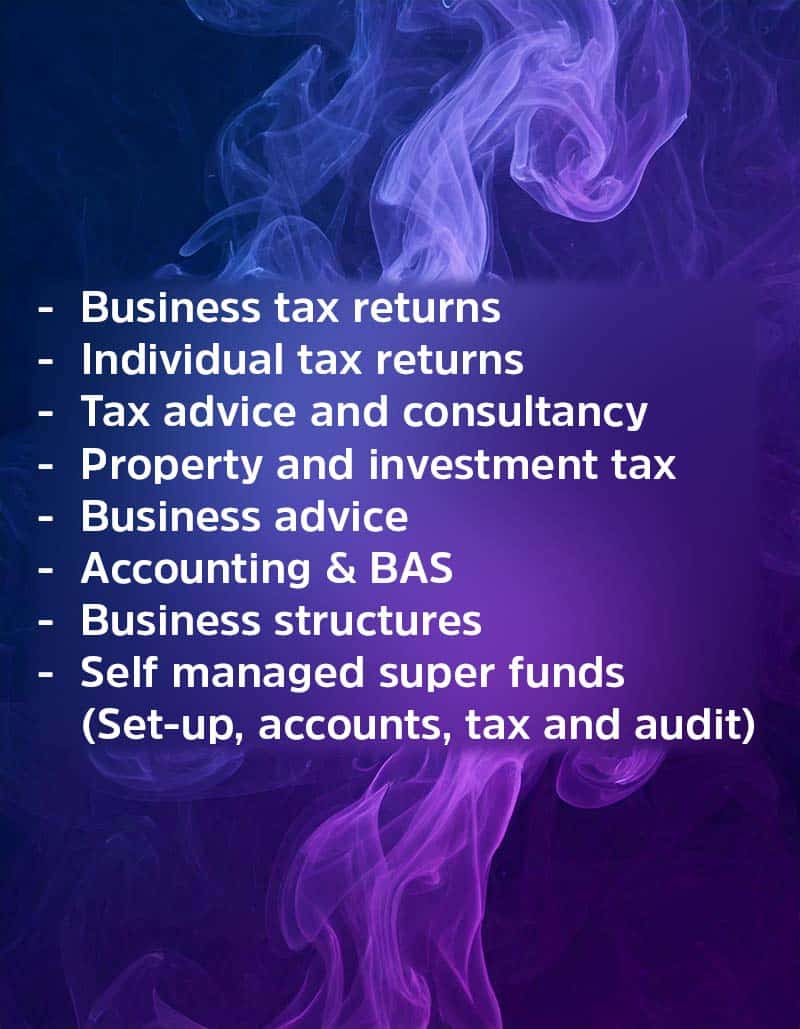

Accounting and taxation services covered by the Travancore practice include:

- Tax returns and consultancy for individuals, businesses and self managed super fund clients,

- Business activity statements,

- Instalment activity statements,

- Accounting and end of year financials,

- Cash flow improvement for businesses,

- Business structure set-up, review and refinement,

- Business advice (advisory),

- Management of ATO inquiries, reviews and audits, and

- Self managed super funds.

- Specialised referral system for advanced services.

With today’s technology services can be provided at the office, on-site or by using Zoom video conferencing, email, document transfer systems and simple straighforward phone calls. This means services can be provided over a wide area including interstate.

Slideshow gallery

(Mouse over image to pause)

Legally reduce your tax liability and make savings.

Details

Travancore VIC 3032

Australia

Mobile: 0405 651 854

Email: [email protected]

Info: Need after hours services? We can help.

Servicing Options

- In person at our office

- Mobile services for business clients

- Phone

- Online video conferencing

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.