Why is household spending going up?

Talkback radio will have you believe Australia is in the grips of an affordability crisis. Interest rates keep rising and inflation is at 7.6%. Apparently, it’s so bad, low to middle-income earning Australians can’t afford to put food on the table, let alone pay their mortgages. So why then are we spending more and more money?

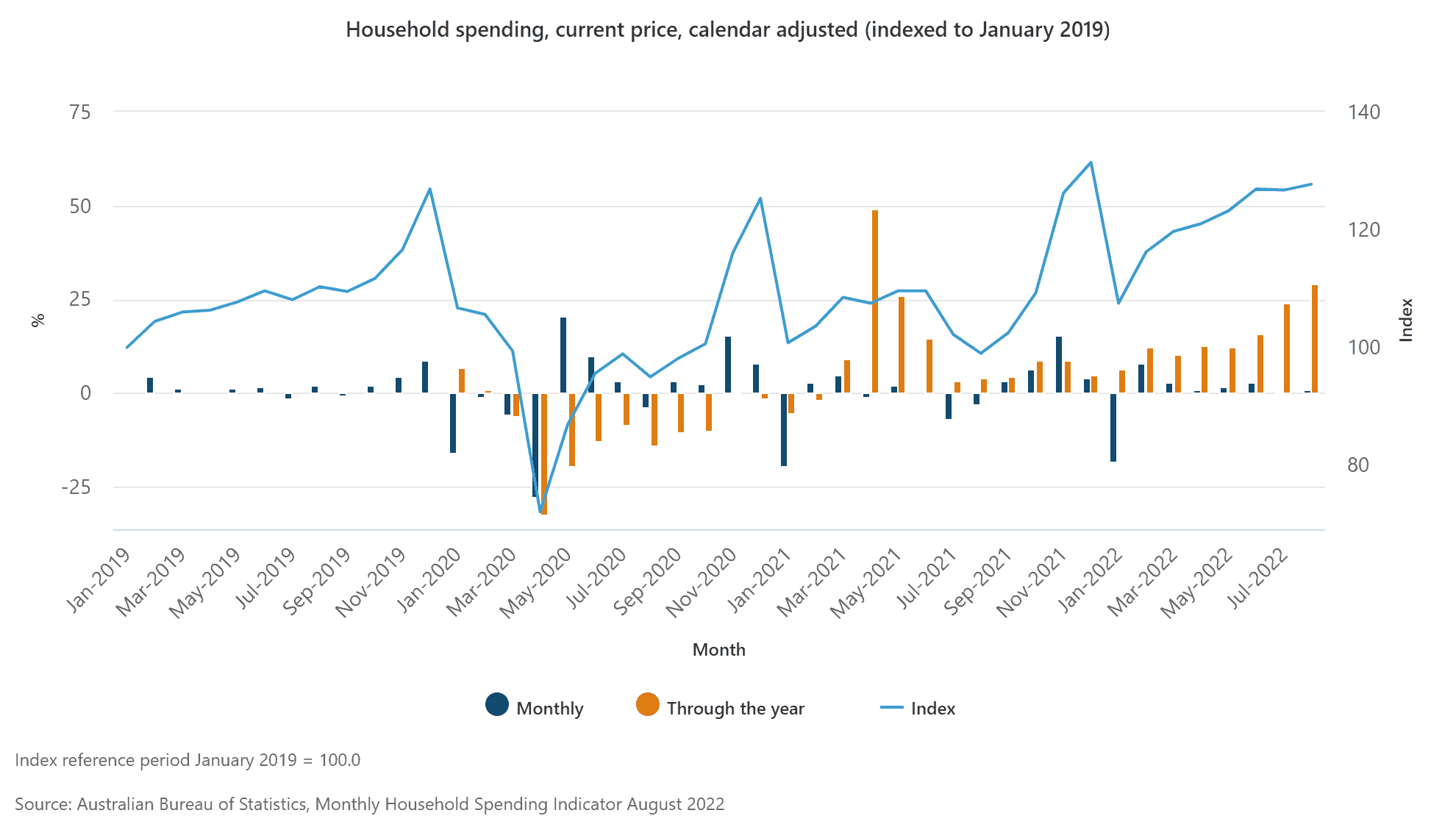

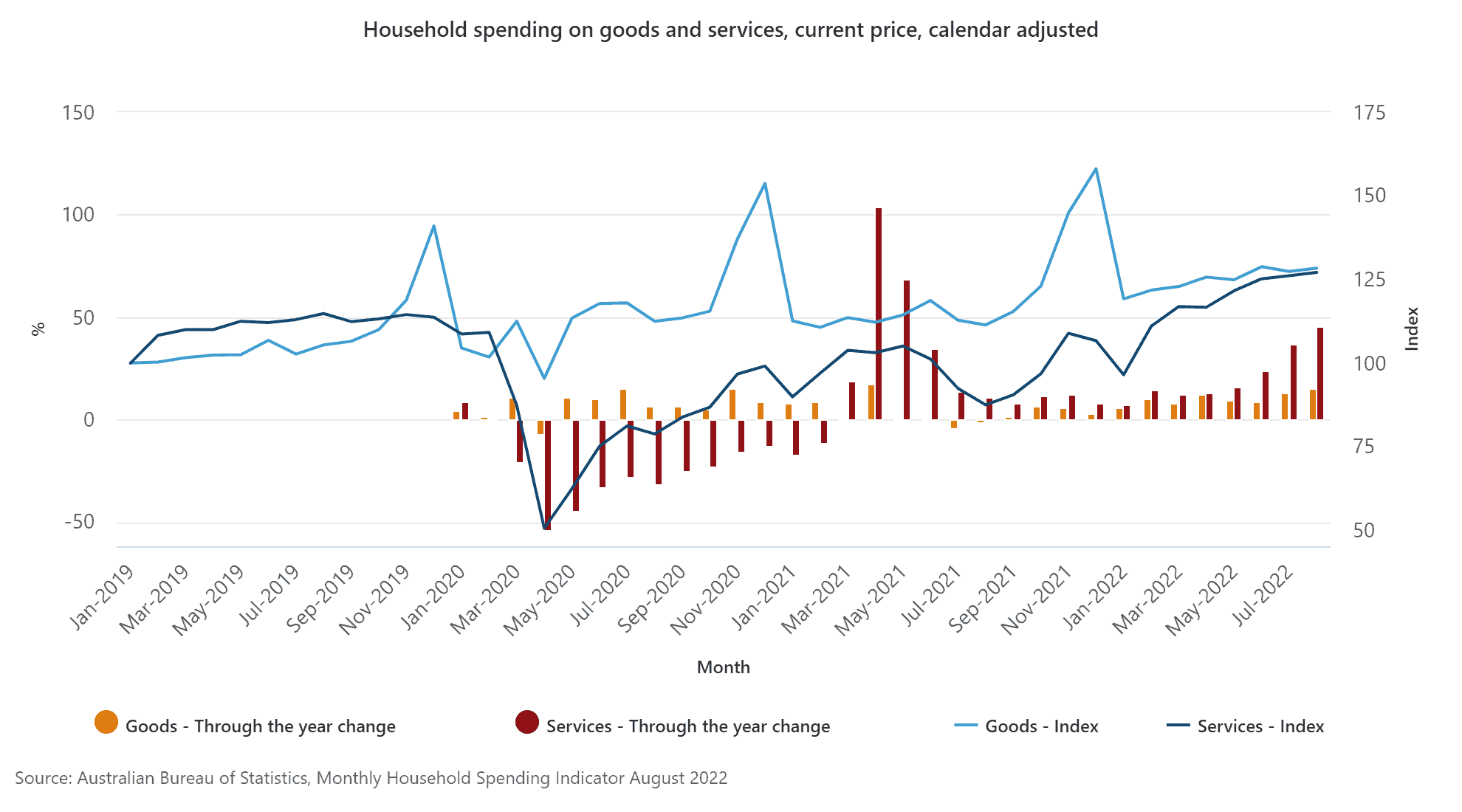

Household spending increased 29% in 2022, +45% on services and +15.3% on goods. Australians’ discretionary spending rose by 29.8% and non-discretionary increased by 28.4%. Despite consecutive increases in interest rates and record inflation, consumer spending keeps rising every month.

So what’s going on?

Whilst we are spending a bit more on goods, the big increase has come from services. As can be seen from the graph below, relatively speaking, rather than spending big on services, we are simply recovering from the service spending crash in 2020 resulting from the COVID lockdowns. In other words, whilst spending is up, it’s coming from record lows in 2020 when spending on services all but stopped in Australia.

Even still, rising interest rates haven’t yet dampened demand with calendar-adjusted household spending above even Pre-COVID levels.